April didn’t just signal change in the Greater Toronto Area housing market—it delivered it, loud and clear. We’re seeing a market in transition: sales are cooling, inventory is rising, and prices are adjusting just enough to shift momentum in favour of buyers. Whether you’re looking to buy, sell, or invest, understanding the data behind these shifts is key to making the right move.

📉 Sales Continue to Slow

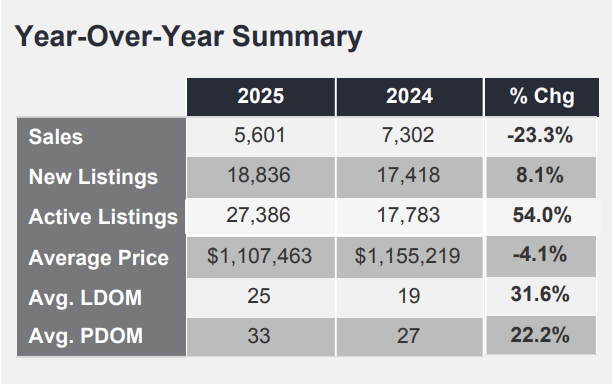

In April 2025, 5,601 homes were sold across the GTA, down from 7,302 sales in April 2024. That’s a significant 23.3% year-over-year drop.

Why the slowdown?

Higher borrowing costs are making buyers cautious

More inventory gives buyers breathing room

Economic uncertainty is holding some buyers back

But this isn’t necessarily bad news—buyers now have time, leverage, and more choices.

🏡 Listings Surge – A More Balanced Market

New listings rose by 8.1% year-over-year, hitting 18,836. More notably, active listings jumped 54%, growing from 17,783 to 27,386.

This means less pressure on buyers and more room for negotiation—something we haven’t seen in years.

💰 Price Corrections Are Subtle, Not Alarming

The average home price in the GTA dipped to $1,107,463, a 4.1% decrease from the same time last year. This is not a crash—it's a soft market correction.

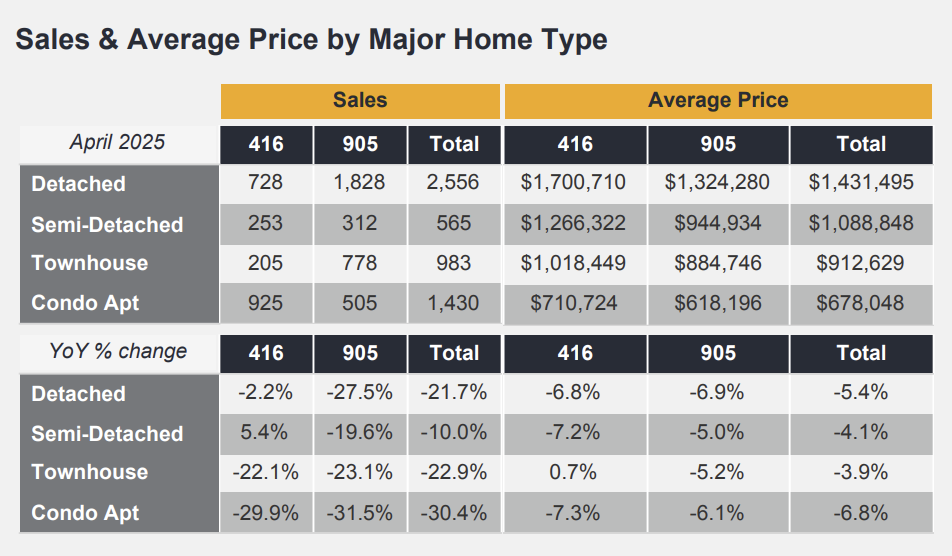

Premium areas are still holding strong:

King: $1,821,545

Aurora: $1,332,712

Richmond Hill: $1,302,226

Meanwhile, more affordable options continue to attract attention:

Georgina: $823,589

Durham Region: $913,500

Simcoe County: $934,913

📍 Where the Action Happened in April

Here’s a quick look at the top-performing regions by total sales:

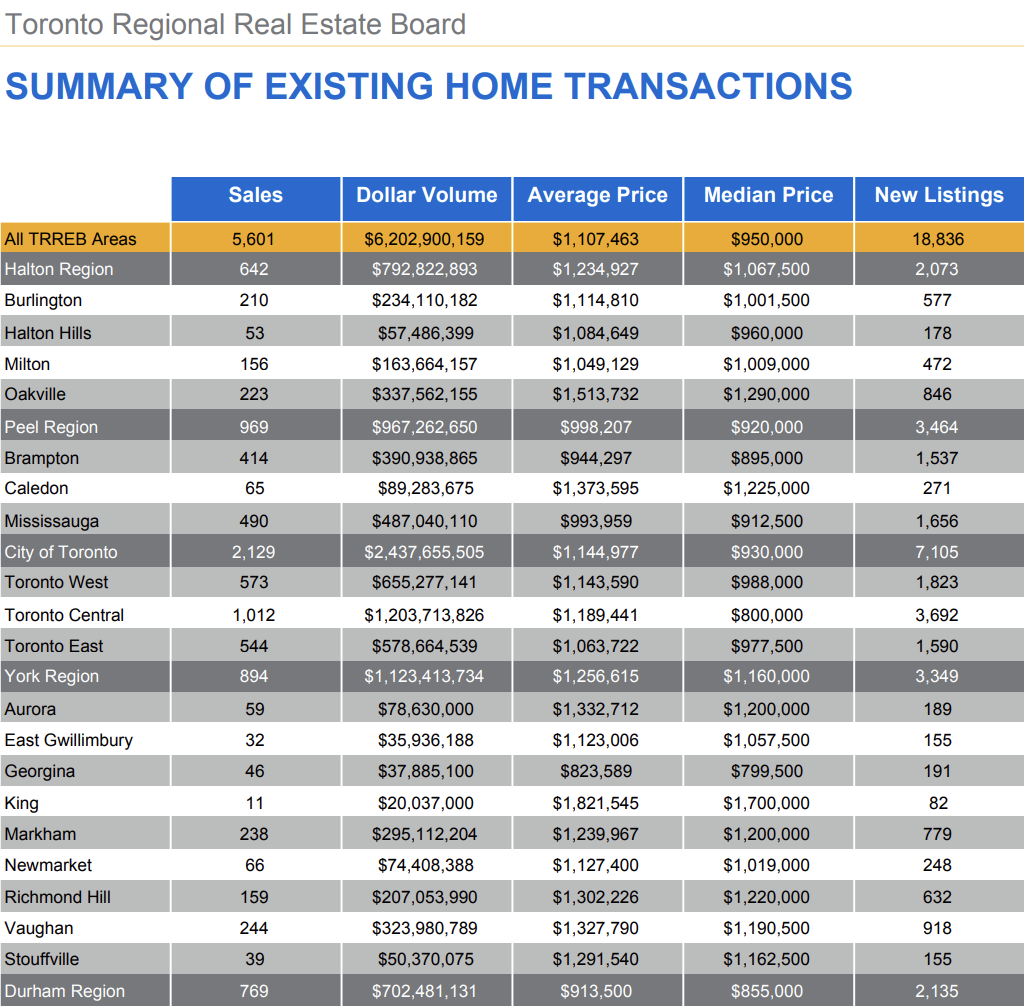

Toronto: 2,129 homes sold | Avg. price: $1,144,977

Peel Region: 969 homes sold | Avg price: $998,207

York Region: 894 homes sold | Avg. price: $1,256,615

Durham Region: 769 homes sold | Avg price: $913,500

🔎 Insight: Toronto Central saw over 1,000 sales with a median price of just $800,000—a clear sign that buyer interest and affordability are intersecting in the downtown core.

⏳ Homes Are Taking Longer to Sell—And That’s Good for Buyers

Average Days on Market (LDOM): 25 days (↑ 31.6%)

Property Days on Market (PDOM): 33 days (↑ 22.2%)

This means sellers are no longer in full control. Buyers have more time to think, compare, and negotiate—something we haven’t seen consistently since before the pandemic.

🧭 The Market Mood – What You Should Know Right Now

For Buyers:

✔ Inventory is growing—so is your negotiating power

✔ Prices are more flexible than they were a year ago

✔ Take your time, but don’t wait too long. This window might not stay open for long

For Sellers:

✔ Pricing matters more than ever—don’t overreach

✔ Strong marketing can set your property apart

✔ Incentives (like flexible closings or improvements) can help secure serious buyers

🔮 What’s Next? Spring 2025 Outlook

Here are the big questions we’re watching:

Will interest rates come down?

A rate drop could spark a wave of buyer activity.Will more listings continue to hit the market?

If so, we may continue to see downward pressure on pricing.Will buyer confidence return?

It’s possible—but not guaranteed. Informed decision-making will be key.

🏁 Bottom Line: This Market Is All About Strategy

This isn’t the red-hot, fast-paced market of 2021—or even 2024. Spring 2025 is a more level playing field where both buyers and sellers can succeed, if they stay informed and act strategically.

📞 Want to move smart in this evolving market? Let’s have a conversation and build the right plan for your next move.