As housing costs rise in Canada, many families are asking: How long can we afford this? Data shows a troubling trend. Over half of Canadians can't handle a 15% cost increase for more than six months. This could force them to move or sell their homes. With higher property taxes, mortgage renewals, and inflation, being financially ready is crucial.

The Reality of Rising Costs

A November 2024 survey by Leger for EveryRate.ca reveals:- 62% of young Canadians (18–24) can only manage higher costs for under six months. The same goes for those aged 25–34 (63%).

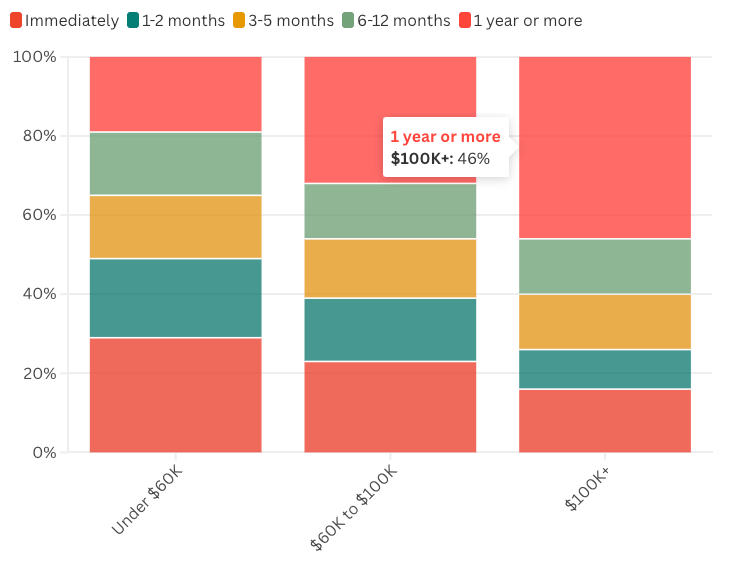

- 66% of low-income households earning under $60,000 a year face the same issue.

- Renters are most at risk. 63% can't handle a 15% increase for six months. In contrast, 44% of homeowners can.

- Families with children and BIPOC respondents report more financial strain.

Understanding a 15% Increase

For homeowners, a 15% rise in a $2,000 mortgage means an extra $300, totaling $2,300. Renters aren't spared. The average two-bedroom apartment costs $1,800. A 15% hike adds $270. Such increases force many Canadians to cut essential spending or rethink their housing.What's Causing Higher Housing Costs?

Several factors are at play:- Mortgage Renewal Shock: Over 1.2 million fixed-rate mortgages will renew in 2025. Many were below 2%. Now, rates are 3.5%–4.5%, raising payments by $200–$300.

- High Interest Rates: Variable rates are slightly down, but fixed rates remain high. This makes new mortgages and renewals costly.

- Rising Property Taxes: Municipalities are raising taxes to cover budget gaps. For example, Toronto's property tax jumped by 9.5% in 2024, adding $380 to a $4,000 bill.

How to Prepare for Rising Costs

Facing financial uncertainty doesn't have to be hard. Here are some steps Canadians can take:- Talk to a Mortgage Broker: Comparing quotes can save you thousands.

- Explore Options: If renewing a mortgage, consider locking in rates early or extending the term to lower payments.

- Create a Budget: Look at your finances and cut non-essential spending.

- Consider a Side Hustle: Extra income can be a safety net.