Many Canadians are counting on a rebound in the property market and an improved economy as the Bank of Canada keeps cutting interest rates. However, there's more to this story that you should know before you get too excited, particularly if you're a Greater Toronto Area (GTA) buyer, seller, or investment.

Why You Find It Important

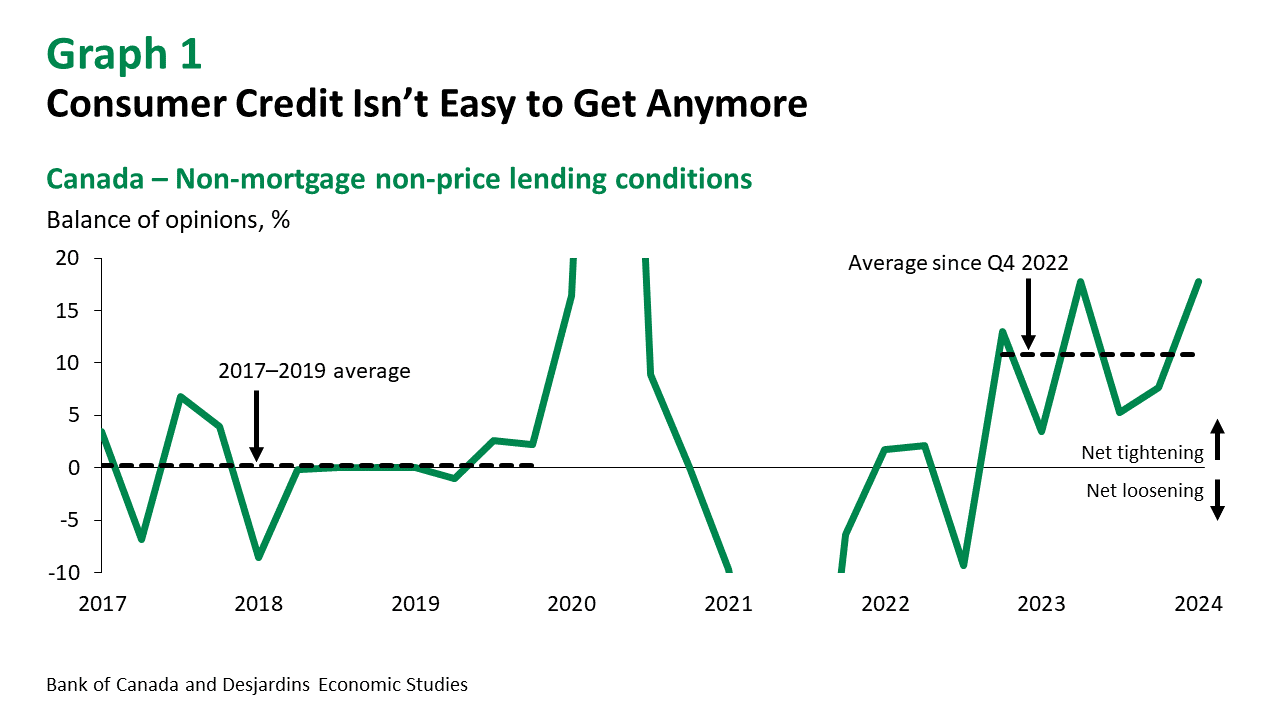

It may be anticipated that reduced rates will facilitate and lower the cost of borrowing, so stimulating consumer spending and—most crucially for the real estate market—home purchases. However, the truth is more nuanced. According to the Bank of Canada, the requirements for household loans have been getting tighter for more than a year. Put simply, this indicates that credit is becoming harder to obtain, for a mortgage or any other kind of loan, even with decreasing interest rates.

This is important information for anyone trying to purchase or sell a house in the Greater Toronto Area. The health of the housing market is directly related to the borrowing power of consumers. The anticipated surge in real estate activity might not occur if financing conditions are tight, which could result in price stagnation or even drops in some places.

This is important information for anyone trying to purchase or sell a house in the Greater Toronto Area. The health of the housing market is directly related to the borrowing power of consumers. The anticipated surge in real estate activity might not occur if financing conditions are tight, which could result in price stagnation or even drops in some places.

The Numbers Behind the Scene

According to recent data, four out of the last five quarters have seen financial institutions tighten their non-mortgage lending requirements (Graph 1). This is a noteworthy trend that hasn't been observed before, with the exception of exceptional situations like the COVID-19 pandemic.

Picture from Desjardins

In addition, the rate of delinquency is increasing. According to Equifax, the proportion of customers who missed at least one credit payment in the first quarter increased by 12.2% from the previous year. Declining credit scores and a decrease in the number of Canadians paying off their credit card balances in full each month are indicators that the country's citizens are finding it difficult to manage their debt.

Why It Matters: The Housing Market's Risk

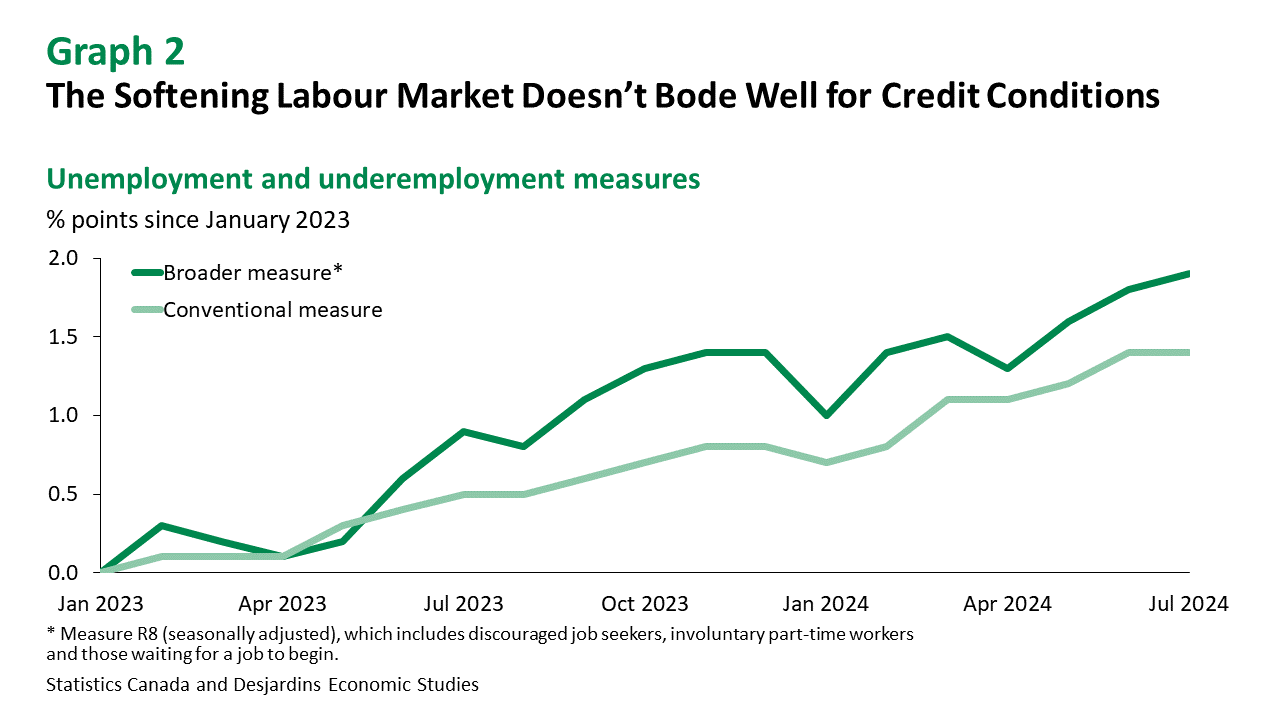

This credit tightening implies that even with lower interest rates, getting a mortgage may be harder for prospective GTA homeowners. Due to declining disposable income and increased unemployment, lenders are likely becoming more conservative. In Canada, the unemployment rate has increased by 1.6 percentage points from its low, while employment has decreased over the past two months.

These two economic indicators (Graph 2) are vital for all those in the real estate industry. If you're purchasing, the process can need more strict checks and possibly larger down payments or interest rates than you had anticipated. If you're selling, you might discover fewer suitable purchasers.

These two economic indicators (Graph 2) are vital for all those in the real estate industry. If you're purchasing, the process can need more strict checks and possibly larger down payments or interest rates than you had anticipated. If you're selling, you might discover fewer suitable purchasers.

The Big Picture: When Will Things Start to Get Better?

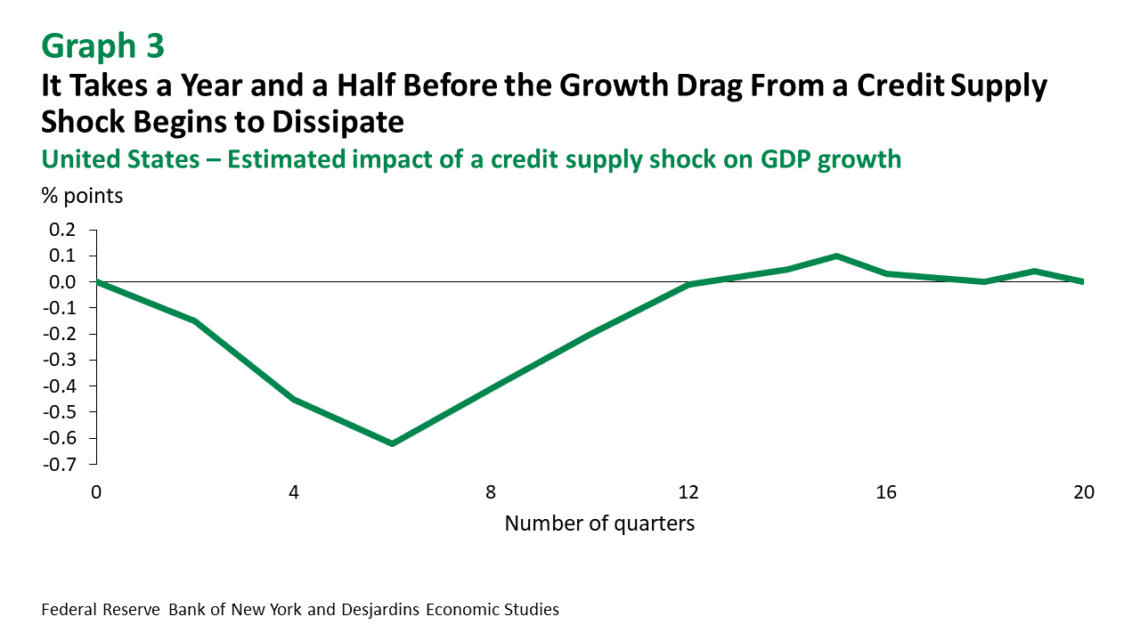

The impact on the economy won't happen right away, even if the Bank of Canada keeps cutting rates. Studies indicate that it takes approximately six quarters, or almost a year and a half, for the effects of a shock to the credit supply to start to fade (Graph 3). Rate reductions are occurring today, but because of this delay, the full benefits may not be realized until well into 2025 or beyond.

Investors may want to exercise prudence during this time. A more noticeable downturn in the real estate market could result from the credit crunch, which could have an impact on rental incomes and property values.

What You Must Do Right Now

Homebuyers should get ready for what could be a more difficult mortgage approval procedure. Make sure your credit is in good standing and think about securing a rate as soon as possible because things might not get better right away.

For sellers, there's a chance that the number of eligible purchasers will decrease. Being flexible with terms and setting a competitive price for your home could be the difference in a deal being closed.

Investors should keep a careful eye on the larger economic indices. Although the short-term market may see volatility that affect both property values and rental demand, the long-term prognosis may still be favourable.

For sellers, there's a chance that the number of eligible purchasers will decrease. Being flexible with terms and setting a competitive price for your home could be the difference in a deal being closed.

Investors should keep a careful eye on the larger economic indices. Although the short-term market may see volatility that affect both property values and rental demand, the long-term prognosis may still be favourable.

Finally, even though reduced interest rates may seem like wonderful news, it appears that prudence is necessary due to the underlying economic fundamentals. Recovering may take longer and involve more obstacles than expected, particularly in the property market. To manage this unpredictable world, be aware, make plans in advance, and modify your techniques as necessary.

Arm yourself with the information you need to negotiate the complexity of the real estate market properly.